What’s next for you?

MOVING UP

Time for more space?

Let’s connect and discover the best plan for you to achieve your dreams!

DOWNSIZING / RIGHTSIZING

A better floorplan does not have to mean a smaller space. Sometimes all you need is a home with the same parts in a better arrangement.

first time home purchase

Congratulations on making the first step toward purchasing your first home! This is an exciting time. Let’s talk through what you are looking for.

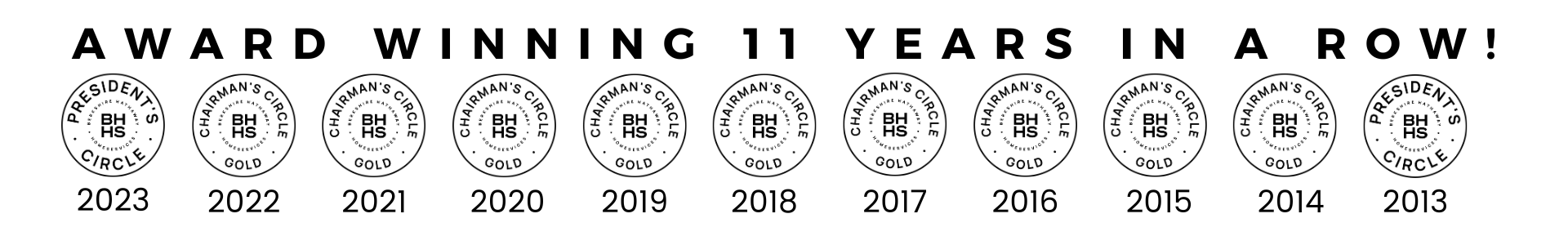

Credentials

- Ranked in the top 5% of Berkshire Hathaway Agents Nationwide

- Multi- year winner of Berkshire Hathaway National Sales Awards

- Consistently ranked a top agent locally and nationally

- Aquinas College cum laude – B.S.B.A.

- Associate Broker

- REALTOR®

- 22+ Years of Experience

- Thousands of real estate transactions negotiated

- Multiple Sales Training & Coaching Programs and Classes

Certifications & Designations

- CRS: Certified Residential Specialist

- A CRS REALTOR ® is a Certified Residential Specialist – ranked in the top 3 percent of real estate agents in the U.S. CRS agents have more experience and training than the average REALTOR ® and they are part of a community of REALTORS ® dedicated to improving the real estate industry for homebuyers and sellers. This designation focuses on upfront mastery of selective skill sets and additional yearly continuing education to ensure we maintain the cutting edge in the ever changing world of real estate.

- MCNE: Master Certified Negotiation Expert

- Continuing education focused on the art of negotiating for our clients. Ranked in the top 2% of agents nationwide that have received negotiation training. When combined with the knowledge gained over negotiating hundreds of transactions, the ability to be a superior negotiator helps every client, every time in every situation. This designation is part of a multi-year continuing education course with extensive training in multiple negotiation styles and approaches with the focus of maximizing returns for our clients.

- IREP: International Real Estate Practitioner

- Real estate transactions affect everyone differently and because housing is a basic human need, people from all over the world find themselves in need of real estate representation. This designation focused on the cultural differences and important information affecting both the many cultural influences and also the impact of certain laws and tax rulings on foreign and domestic real estate transactions.

- SFR: Short Sale and Foreclosure Resource

- Short sales and foreclosures differ from any other type of real estate sale. Negotiating with multiple parties while seeking to aid the client involved in the sale or purchase of a short sale or foreclosure. While representing sellers experiencing a short sale or foreclosures, emotions run high and ensuring all steps are completed appropriately is paramount to success. For buyers working through a short sale or foreclosure purchase can take multiple steps outside a “normal/traditional” real estate transaction. This designation focused on understanding the best approaches to this unique segment of the market with the focus on improving both the impact for clients, and the community at large.

- SRES: Senior Real Estate Specialist

- This designation focuses on the necessary knowledge and expertise to counsel clients age 50+ through major financial and lifestyle transitions in relocating or selling the “family home.” Including areas of consideration in “age-in-place” desires, senior communities, floor plan accommodations and other similar aspects.

- e-PRO:

- Understanding and utilizing online technology is paramount in maintaining the cutting edge in real estate. Marketing and meeting clients’ needs through online technology is a must in today’s market and the e-PRO designation focuses on social media, video, blogging, photography, online web presence and strategy to educate, inform, and empower its designation holders.

- Master of Brokerage Principles (MBP):

- This certification is presented to GRAR REALTOR® members who have completed enhanced education specifically aimed at the brokers whose role is much more complex than that of a salesperson. Members who have received this certification have undergone specialized management training in best practices, key issues facing broker/owners including trust accounts, ABAs, cyber security, fraud protection, and more.

- Pricing Strategy Advisor (PSA):

- The Pricing Strategy Advisor (PSA) certification. The focus of the PSA certification is to deepen the knowledge and skills set for pricing properties and working through complicated property cases with appraisers. Enhancing pricing skills and practices when advising and serving each buyer and seller.

- Associate Broker:

- In Michigan not all real estate agents are Brokers. You must first be licensed as a real estate agent for minimum of 3 years and have successfully completed 36 transactions and then enroll and complete the additional 90 hour education course and then sit for and pass the state exam. In the state of Michigan only a broker may have their own separate real estate practice. When a broker chooses to be part of a larger organization they obtain the Associate Broker title. The licensing is the same but there is a different structure within the organization itself. In my case, we have a management team who manages the franchise rules and regulations, other agents, and daily affairs such as staffing and such – meaning I do not have to spend my time on such issues allowing me to focus on my clients and the parts of the business I love and excel at.

- REALTOR®

- Not all real estate agents are REALTORS®. Being a REALTOR® is an elective designation that I have chosen to be affiliated with. Licensed real estate agents in general do not subscribe to a code of ethics they are simply required to pass a state exam. As membership into the Association of REALTORS® we must and do accept and adhere to our code of ethics and professional code. I am proud to be a part of the National Association of REALTORS®, Michigan Association of REALTORS® and our local board, Grand Rapids Association of REALTORS®.

About John

John Rice has a passion for helping others, combined with his love of real estate – being a real estate professional is a natural fit! Since beginning his career in real estate in 2002, John has grown to be ranked in the top 5% of Berkshire Hathaway HomeServices Agents nationwide, winning multiple national awards for sales volume, John has accumulated years of knowledge and experience from representing hundreds of buyers and sellers.

As a husband and father, John, knows the value of surrounding yourself and your family with the right environment – especially the place you want to call home . As a former wealth adviser, John’s astute knowledge of how real estate fits into financial planning have assisted many in both planning and acquiring wise investments and also when and how to act on certain real estate transactions.

The large network of buyers and sellers that John Rice has serviced over the years has been largely built by referral and his top rate ability to effectively market sellers’ properties to the right audience. This in combination with years of non-profit service have allowed to John Rice to positively impact the local community on many levels.

Beyond Real Estate

- Husband & Father: We look to instill in our family the passion of enjoying life and recognizing the gift of life we’ve been given here on earth. Being thankful and knowing the value of working hard and helping others. Raising our family to know strengths and passions. Family time to us is simple: spending time together. It does not need to be a grand production. It’s the togetherness that makes the difference.

- Hobbies: Love spending time as a family experiencing this great world we live in. As a family you can often find us exploring this great state, at the beach, going for bike rides and hikes, and anything in and around water. We also love to experience museums and historical sites, state and national parks so we visit as many and as often as we can. Knowing where we have come from gives us great insight and perspective to the past and path for our future.

- Community: All of us – TOGETHER – provide the backbone to making this community great. I love volunteering within the community. Giving back and investing time and treasure to ensure our community remains strong, vibrant and growing. Here are a few of the organizations I support to help our community grow and prosper:

- Grand Rapids Lions Club – past president and board chairman

- Kids Food Basket – volunteer and supporter

- Grand Rapids Chamber of Commerce: volunteer, member and supporter

- Economics Club of Grand Rapids – member and supporter

A few of the non-profits I give my time and support to that are focused on helping to enable and strengthen our community:

We have many wonderful organizations here in West Michigan, helping our area grow. A few of the community centered organizations I am actively involved in that are centered on building a strong, vibrant, Greater Grand Rapids MI and West Michigan:

What Our Clients Are Saying:

We would love to hear from you!

Let’s connect and get you on the path to success!