Sales Contracts Hit Highest Level in Months

The National Association of Realtors (NAR) just announced that the February Pending Home […]

Sales Contracts Hit Highest Level in Months

The National Association of Realtors (NAR) just announced that the February Pending Home […]

The Top 5 Reasons You Should Not For Sale By Owner

In today’s market, with homes selling quickly and prices […]

The Top 5 Reasons You Should Not For Sale By Owner

In today’s market, with homes selling quickly and prices […]

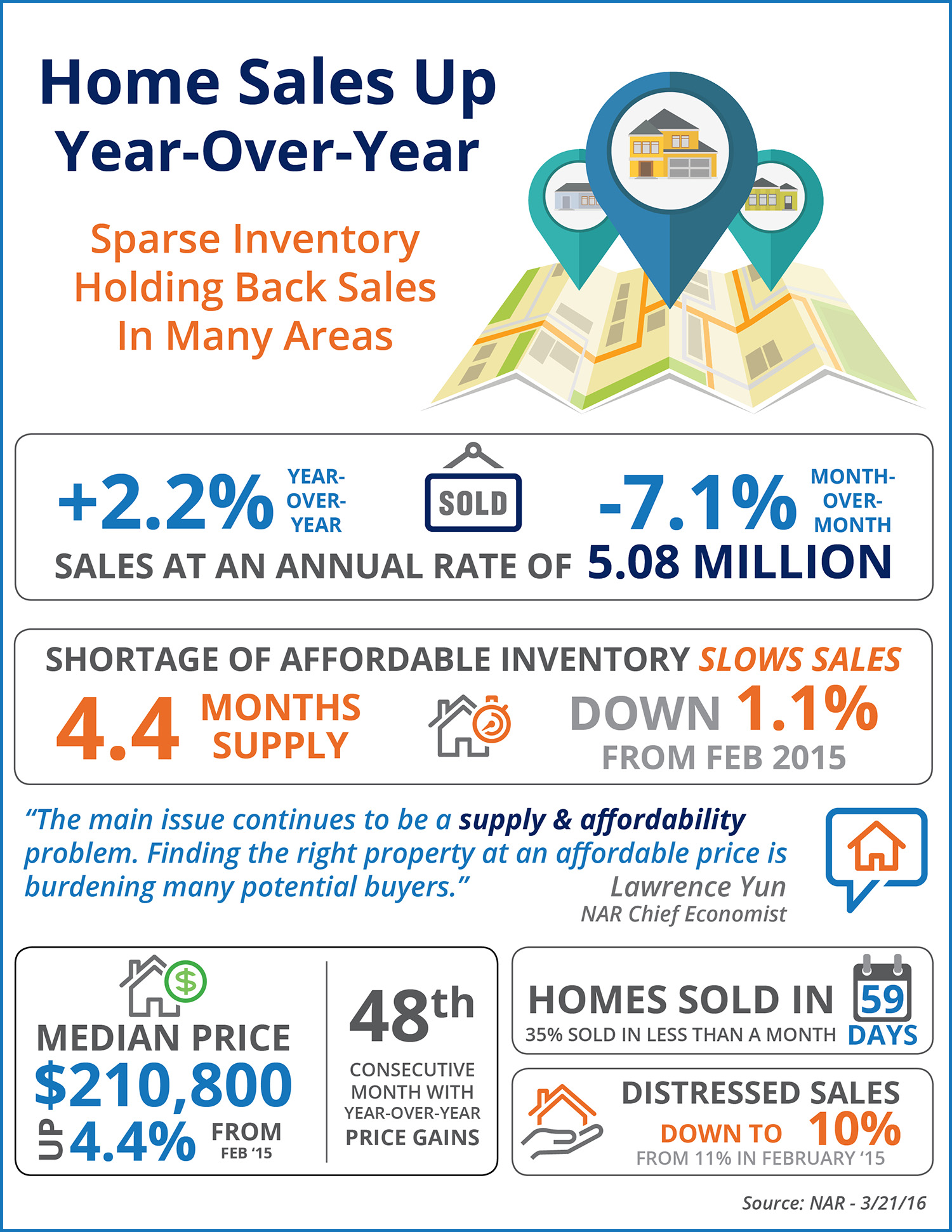

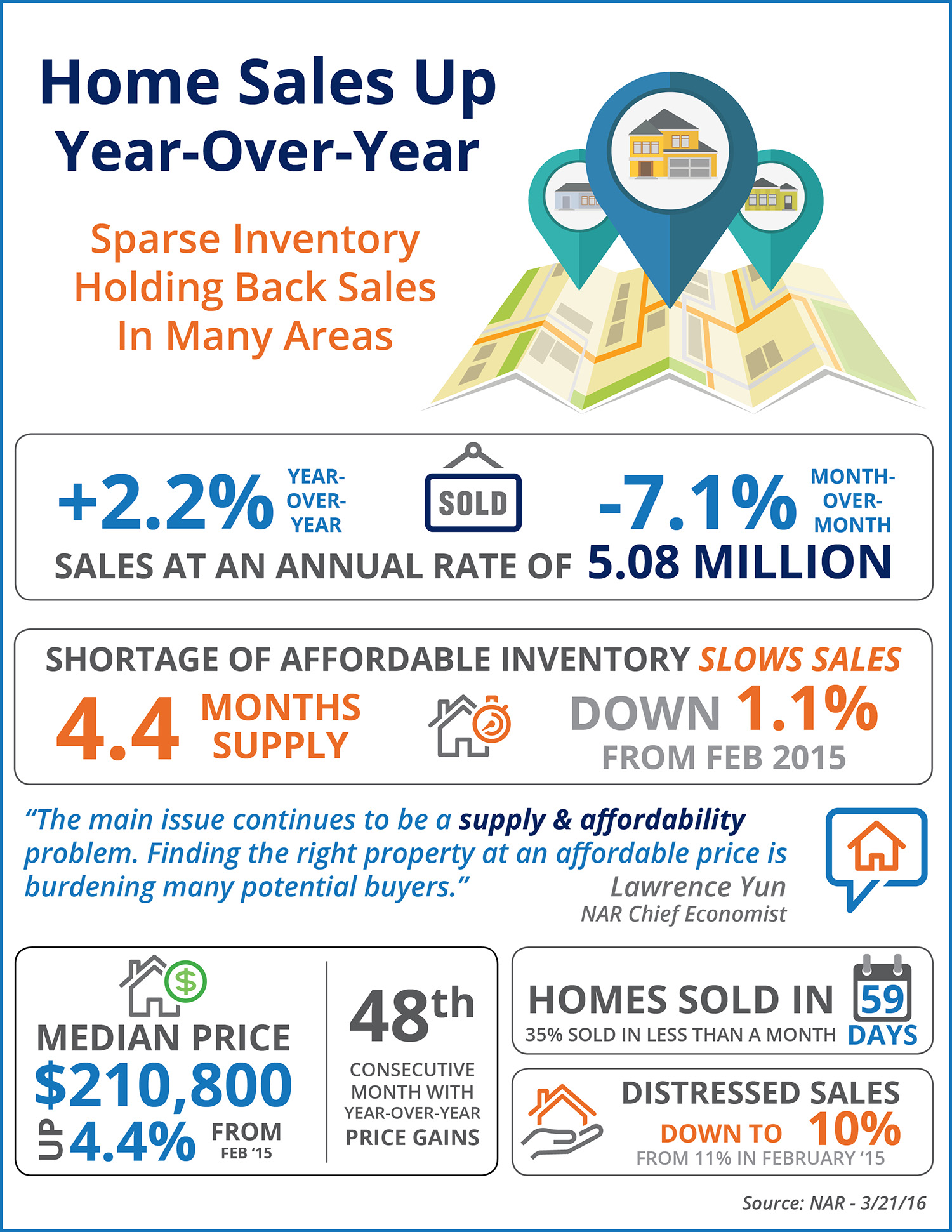

Home Sales Up Year-Over-Year

Some Highlights This is the 48th consecutive month with year-over-year price gains. Lawrence Yun, NAR’s Chief […]

Home Sales Up Year-Over-Year

Some Highlights This is the 48th consecutive month with year-over-year price gains. Lawrence Yun, NAR’s Chief […]

Further Proof This Isn’t a Housing Bubble

Two weeks ago, we posted a blog which explained that current increases in […]

Further Proof This Isn’t a Housing Bubble

Two weeks ago, we posted a blog which explained that current increases in […]

91.5% of Homes in the US have Positive Equity

CoreLogic’s latest Equity Report revealed that one million borrowers regained equity […]

3 Charts That Scream ‘List Your Home Today’

In school we all learned the Theory of Supply and Demand. When […]