GRAND RAPIDS, MI Ranked #20 on the list of the Best Places to Live in the US USNews.com USNEWS.COM For […]

This brand new and incredible tracker is available for FREE. This is designed to help you keep track of activity […]

Knowing the numbers is KEY to todays’ market. Take the #1 easiest step and start by clicking here for your […]

February 2024: Quick tips for this month: Furnace Filters and Bathroom Updates: 1.) Furnace Filter: How is that furnace working? […]

Grand Rapids MI (February 7th, 2024) — Berkshire Hathaway HomeServices Michigan Real Estate today announced that John Rice has been […]

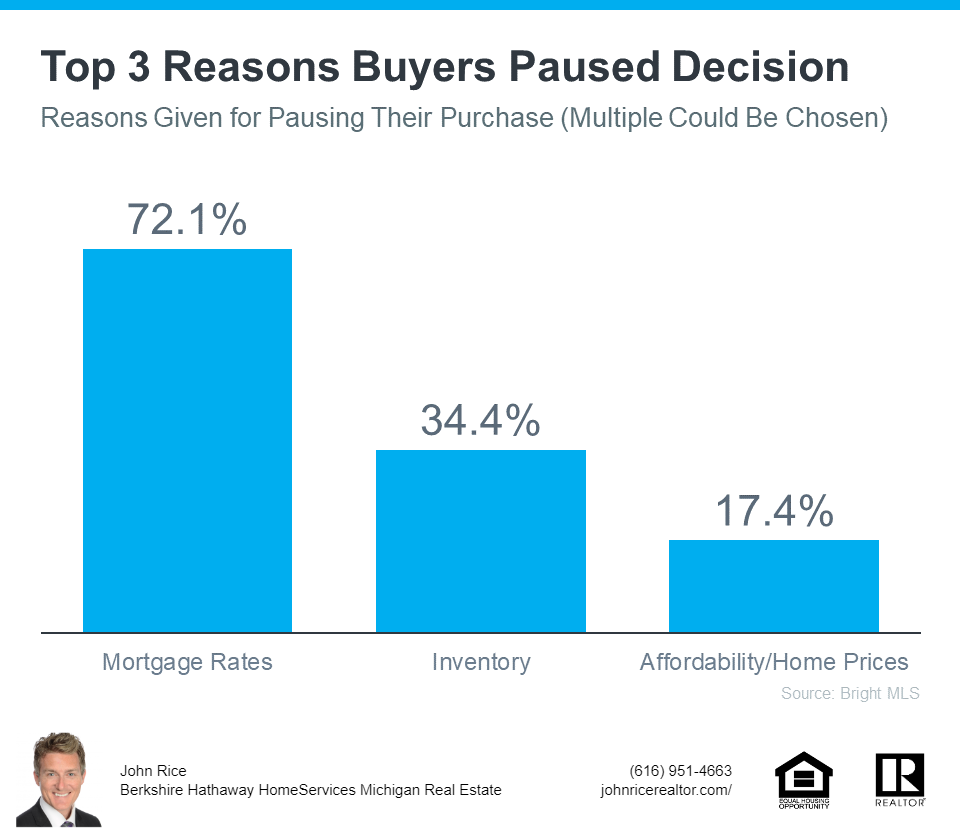

The January 2024 numbers are in and bottom line: the market continues to APPRECIATE. The average sales price is up […]

Tracking the local market including, recently closed sales can be helpful in understanding several variables in the market. Below is […]

2 Reasons Why Today’s Mortgage Rate Trend Is Good for Sellers If you’ve been holding off on selling your house […]

Move-in ready! This SE charmer offers an inviting floor plan with an updated beautiful open kitchen featuring butcher block tops, […]