Bed and Breakfast, Multi-Unit, Single Family, add extra ”tiny houses” – the options are endless! Your retreat awaits! Enjoy this […]

2 Factors to Watch in Today’s Real Estate Market Whether Buying or Selling When it comes to buying or selling […]

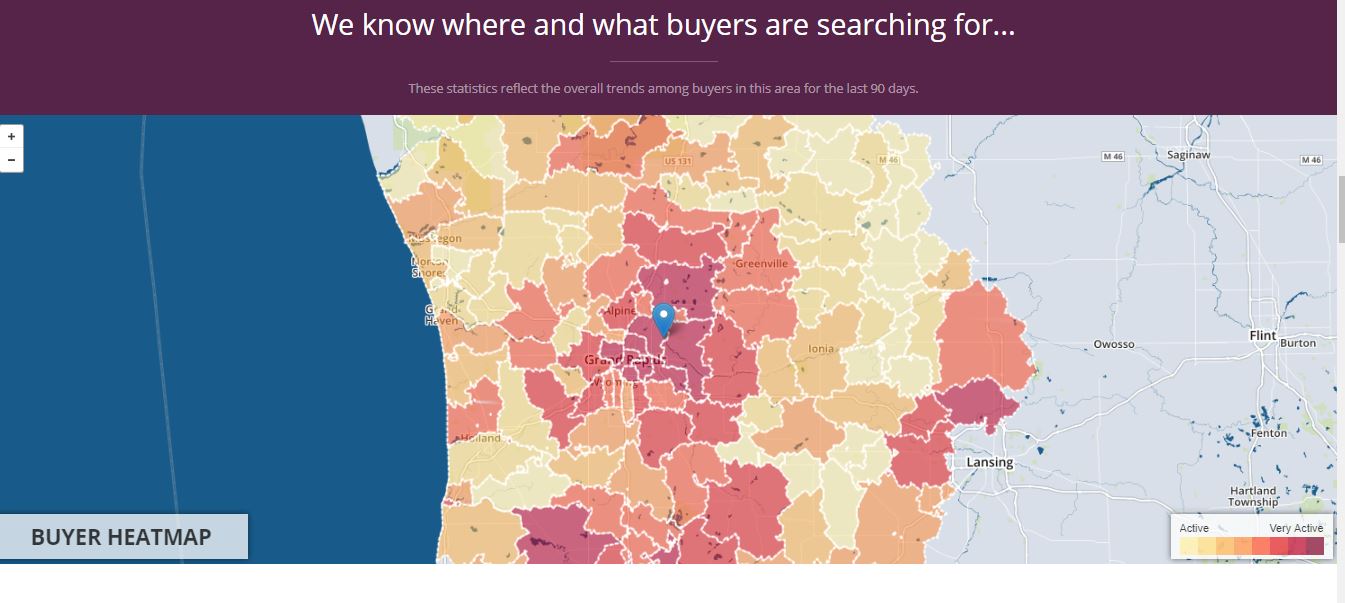

Ever wonder just how HOT the market is near you? Want to know if buyers have been searching for a […]

Where Are Mortgage Interest Rates Headed In 2019? The interest rate you pay on your home mortgage has a […]

How Much Has Your Home Increased in Value? Home values have risen dramatically over the last twelve months. In CoreLogic’s most recent Home Price […]

Beyond Home Valuation: Check current market values for your home and view profiles of potential buyers. An automated value estimate […]

Is the Real Estate Market Finally Getting Back to Normal? The housing market has been anything but normal for the […]

Your needs are first and foremost. With time tested measures to ensure success, John Rice features the exclusive HOMESt.A.R.® process […]

Ask the Realtor: What does it take to buy a home in today’s market?

Ask the Realtor: How Important is Location? We’ve heard it over and over again: location, location, location – but how […]