Forest Hills Central Schools! Step into this custom designed, 4 bedroom home featuring main floor master with 2 offices on […]

Berkshire Hathaway HomeServices has awarded John Rice the Chairman’s Circle Gold Award for 2020 production. The award is presented to […]

Excellent home with updated bath, attached garage, finished basement, fenced in backyard and it backs right up to a park! […]

Looking for the perfect lot to build your DREAM HOME? Want acreage and beautiful barn and a great place to call home? This is it!

Forest Hill Schools – Private Thornapple River frontage. This gorgeous Town & Country cedar home is surrounded by the natural […]

Perched on the highest elevation of this beautiful 33 acre parcel, this 3800+ sqft home features main floor master, soaring […]

This Nantucket inspired cape cod residence designed by Jeff Visser, built by Andy Vandermale, and landscaped by Tom Rooks, features […]

Buyers Are Finding More Space in the Luxury Home Market A year ago, additional space and extra amenities had a […]

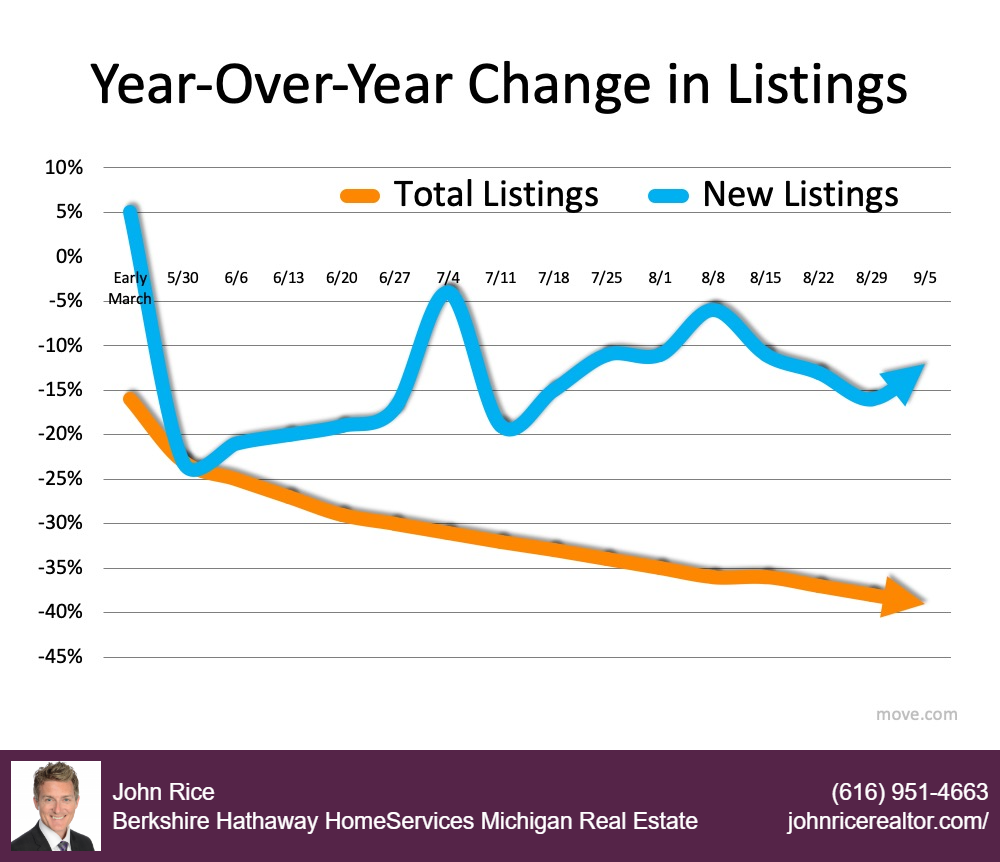

Fall 2020 Real Estate Trends Real estate continues to be called the ‘bright spot’ in the current economy, but there’s […]

New, new, new! Looking for a perfect home with practically all new everything? This is it! From the stamped concrete […]