Tracking the number of CLOSED sales can be helpful in understanding several variables in the market. Below is a brief […]

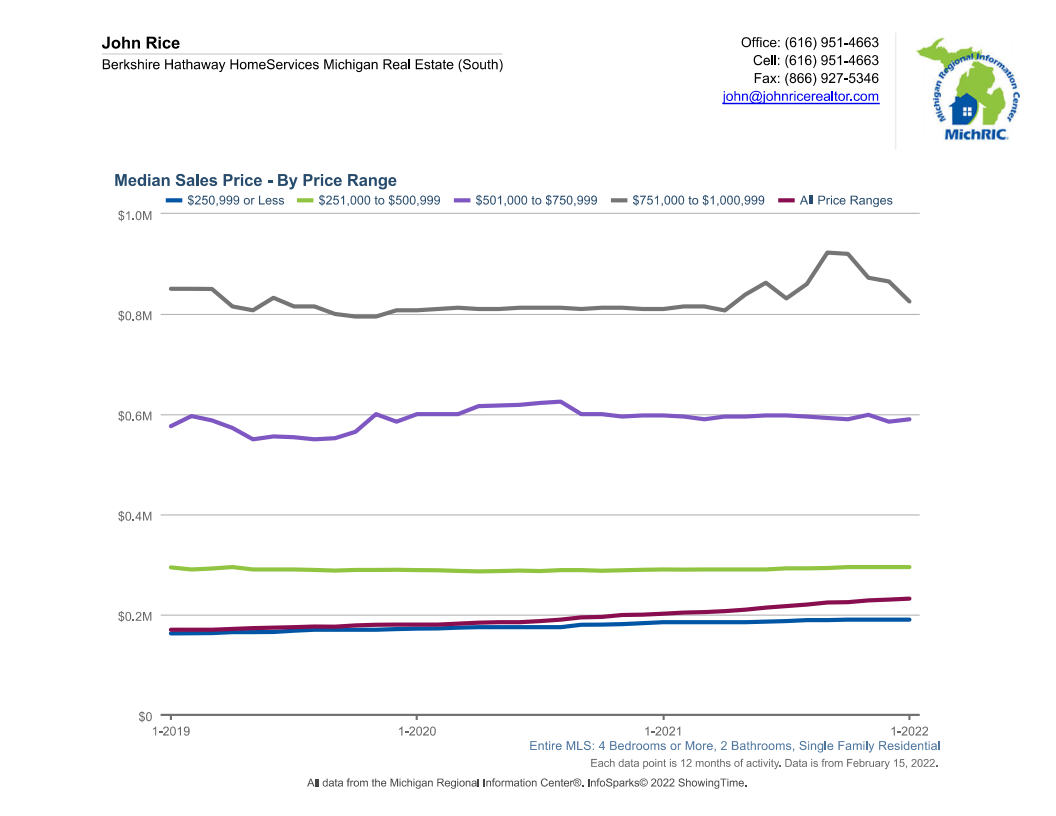

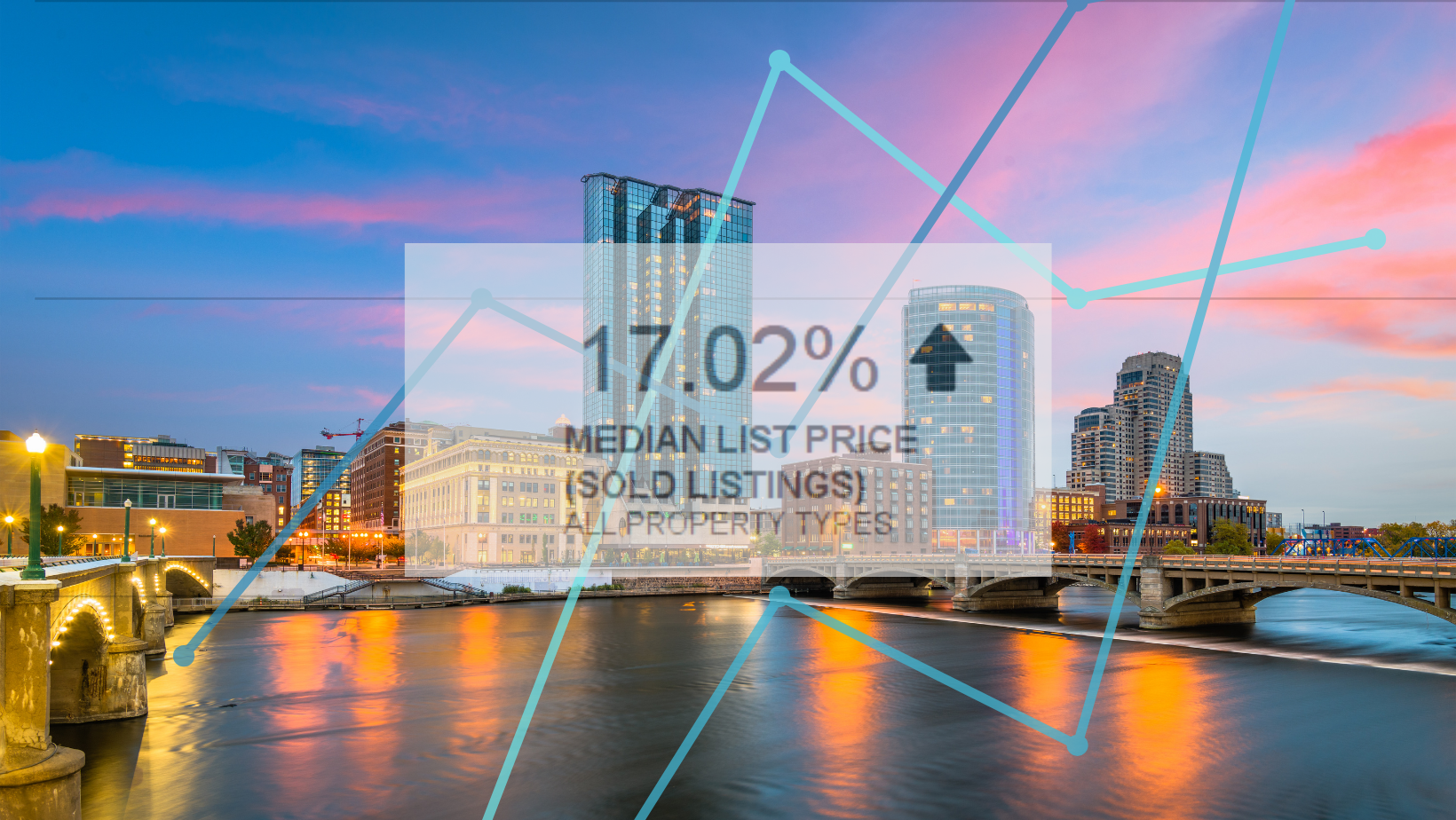

Read the latest report here: GR Market Report shows 17.02% jump over last year (Feb 21 vs Feb 22 Median […]

Berkshire Hathaway HomeServices has awarded John Rice the Chairman’s Circle Gold Award for 2021 production. The award is presented to […]

Expert Insights on the 2022 Housing Market As we move into 2022, both buyers and sellers are wondering, what’s […]

2021 FALL REAL ESTATE UPDATE brought to you by John Rice REALTOR Berkshire Hathaway HomeServices

Demand for Vacation Homes Is Still Strong The pandemic created a tremendous interest in vacation homes across the country. Throughout […]

Exquisite one of a kind contemporary home on 10 acres. Featuring soaring cathedral ceilings, showcase granite faced fireplace, main floor […]

Minutes from all your favorite hang-out spots, East Grand Rapids schools, beautifully updated and ready for you. This 4 bedroom […]

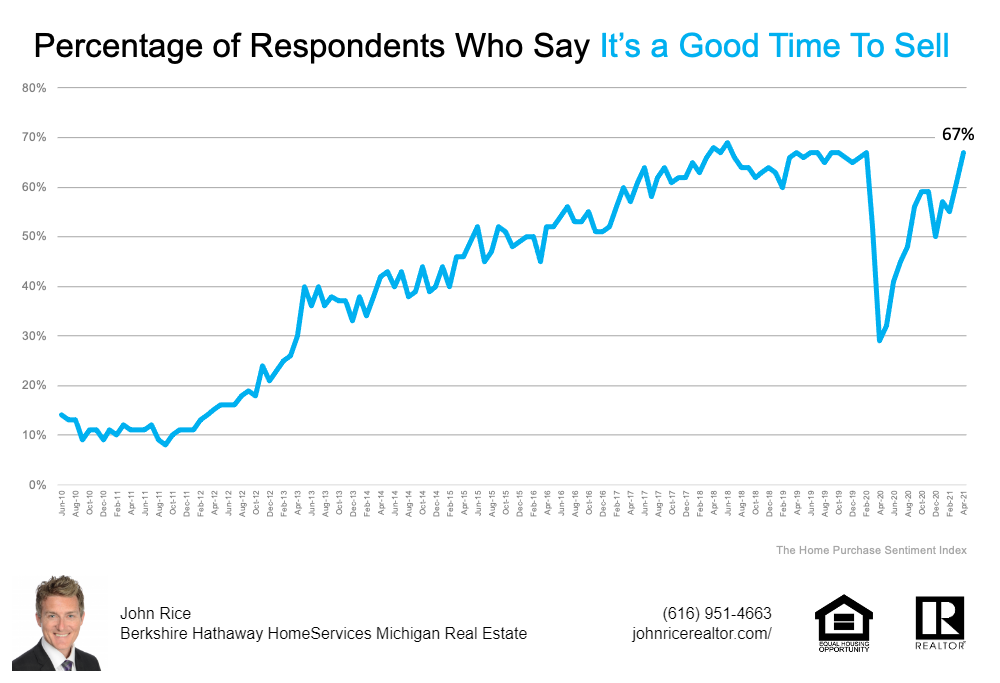

Sellers Are Ready To Enter the Housing Market One of the biggest questions in real estate today is, “When […]